Suspected fraud in GHG quota fulfilment

06.05.2025

The fulfilment of the greenhouse gas reduction quota (GHG quota) in Germany and Europe in recent years has given rise to concrete suspicions of fraudulent activity. Karin Naumann, Karl-Friedrich Cyffka and Franziska Müller-Langer from DBFZ have analyzed the situation in a recent background paper.

For context:

Current legislation obliges companies that place fuels on the market to fulfil a certain GHG quota in order to reduce emissions. This quota can be met with the help of biofuels or electromobility, for example, and increases annually until 2030. There are specific requirements in relation to the underlying raw materials and, in case of non-compliance, compensation payments are due. Certain so-called ‘advanced’ fuels are particularly incentivized in the GHG quota by being allowed to be double-counted above a certain quantity.

The pressure on companies due to higher quotas and the restriction of permissible compliance options is increasing, and the demand for compliance options with low costs and low risks is growing. In principle, it is possible to transfer one's own quota obligation to third parties, which has led to the establishment of emissions trading. The price is determined by supply and demand and works according to the merit order principle. Savings certificates are also issued by commercial providers.

---

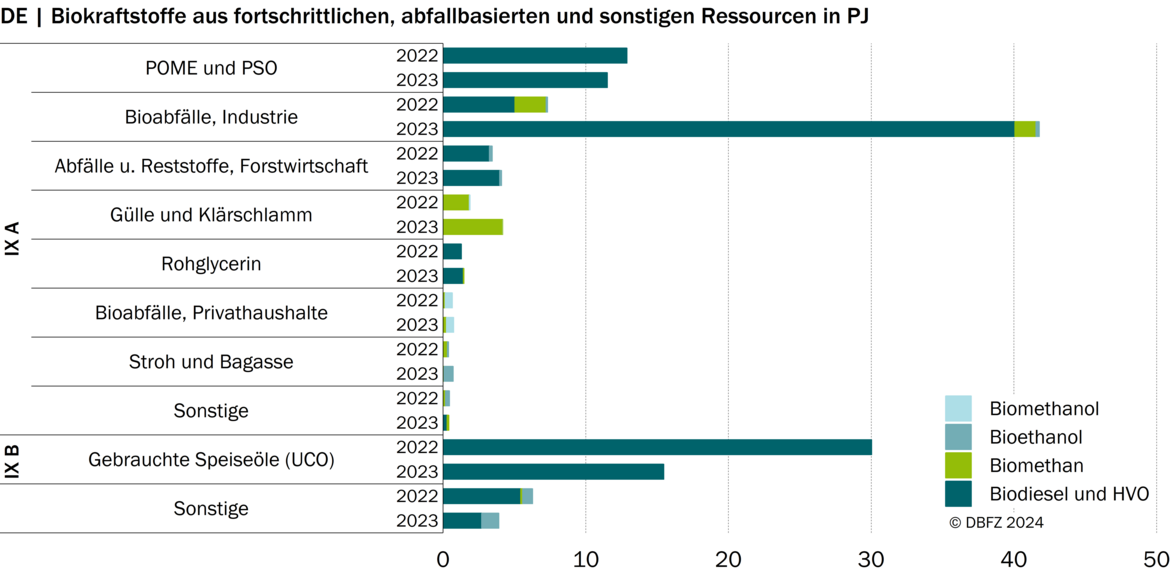

The volume of advanced biofuels in the German GHG quota is increasing rapidly. However, this increase is progressively based on biomass fractions from industrial waste. UCO (used cooking oil) in particular, but also POME (wastewater from palm oil production), declined in 2022 and 2023. The combination of the oversupply of advanced biofuels and the comparatively moderate increase in the GHG quota is a key reason for the ongoing price collapse in quota trading. The quota is being significantly overfulfilled, causing quota prices to fall and increasing price pressure on fuel producers and operators of charging infrastructure. While the GHG quota was originally intended to promote climate-efficient drives and fuels as well as their production capacities in Germany and Europe, this is only the case to a very limited extent. Chinese companies in particular benefit from the high import share of advanced fuels and the favorable compliance options are an advantage for the mineral oil industry.

The following diagram illustrates the development in 2022 and 2023:

The crediting of fuels from biogenic industrial waste for the GHG quota is unlimited and, statistically, it cannot be clearly ruled out that certain quantities of this waste originate from palm oil processing. There is a suspicion of fraud through the erroneous double counting of unauthorized fuels. There have been reports from various bodies to national and international stakeholders about a possible fraud in connection with biofuels from palm oil-based residues and waste since the beginning of 2023. In 2024, the offsetting of quota fulfilments from previous years was initially suspended at national level for the years 2025 and 2026 and the European Commission introduced anti-dumping measures for biodiesel imports from China.

In addition to the existing doubts about material flows that are declared and certified as POME, there is now also a public statement from Indonesia: According to the Ministry of Trade, the export quantities of palm oil-based residues far exceed the quantities plausibly available in Indonesia in 2023 and 2024. Improved monitoring of raw materials at EU level, not only for fuels, seems necessary. The revision of the GHG quota, which is due soon, should be used to make the legal framework less susceptible to fraud, initially at national level.

Further information can be found here:

- DBFZ background paper on quota fulfilment

- Evaluation report by the Federal Office for Agriculture and Food for 2023 (in German).

Comments

No Comments

Write comment